Image credit: AI Generated

By: Priya Dubey

e-Rupi has come into existence to surpass the traditional payment system. It is India’s most recent revolution in digital currencies and transactions. It is the initiative taken by Govt of India to grant a cashless payment solution for COVID-19 vaccination. The one-time payment mechanism is like a pre-paid gift card without plastic or metal cards. It is delivered to users’ mobile phones in the form of a QR code or an SMS string. This digital voucher can then be redeemed at any merchant accepting e-Rupi, without the need for a debit or credit card, a mobile wallet app, or even an internet connection.

Who issued the Digital e-Rupi Vouchers?

The Reserve Bank of India is a central bank that solely regulates and formulates monetary policies and takes decisions to shape Indian rupee-related supply and demand in the economy.

Press Release 2022-2023 dated November 29, 2022, the Central bank announced the issuance of the first pilot for digital Rupee {e-Rupi} on December 01, 2022.

What is e-Rupi, or Digital Currency all about?

The electronic rupee is a Digital copy of paper currency, An innovative digital solution introduced in India to increase efficiency and transparency in transactions. e-Rupi in the economy will lead to financial inclusion in upcoming years. It is trying to provide a certain amount of access to formal banking services.

For any Currency to be legal tender it must be fiat money (It is a type of currency that derives its value from the fiat of the government rather than being backed by physical commodities like gold or silver) and must be accepted as a medium of payment.

CBCDs backed by RBI called e-Rupi as a Digital Alternative

Finance Minister Nirmala Sitaraman declared the initiation of CBDC in the Union budget, the capacity of a sovereign currency. users can enjoy the benefits of digital currencies due to the government’s governing and overseeing the risk associated with it. Just like cash notes, e-Rupi can be used in the nook and corner of India. It’s not required to hold deposits in bank accounts. The RBI released only the first type of digital currency on behalf of GOI, which is a liability on a Central Bank balance sheet.

CBDC Is Going To Be The Future Currency Of The World, Says RBI Guv On India’s Digital Payment Growth

1. No Need for a Bank Account

e-Rupi is projected to aim against the setbacks coming in the Direct benefit transfer (DBT), scholarships and subsidies, etc. It is a fact that it will play a prime role in the core banking system. Payments through DBT will not need an account to transfer the amounts for the scheme purposes. Users will only need a mobile phone and the application of it via the digital rupee wallet costs fewer transaction fees since there is no necessity for intermediaries and as such interbank settlements.

2. e-Rupi, to be accessible to a broader segment of customers

According to a press release from the PIB website, NPCI has partnered with more than 1600 hospitals. NPCI has partnered with 11 banks for smooth digital transactions. And more participating banks and online apps are excited to join the e-rupi initiative soon. In the coming days, RBI has declared that it will give private players like retail and wholesalers the upper hand in a sustained manner. It will enable non-bank payment system operators to offer CBDC WALLETS on a broader level.

Is the e-Rupi a Digital Currency?

Yes, you can say that the e-Rupi is a digital rupee, However, it has not been officially declared as such. It is a social service voucher system to secure the benefits that reach out to intended beneficiaries even in interior and backward areas without any difficulties and delays. It will be a great experience and a great lesson for GOVT to learn the framework of digital currencies and if there are any loopholes then doors are open to improve.

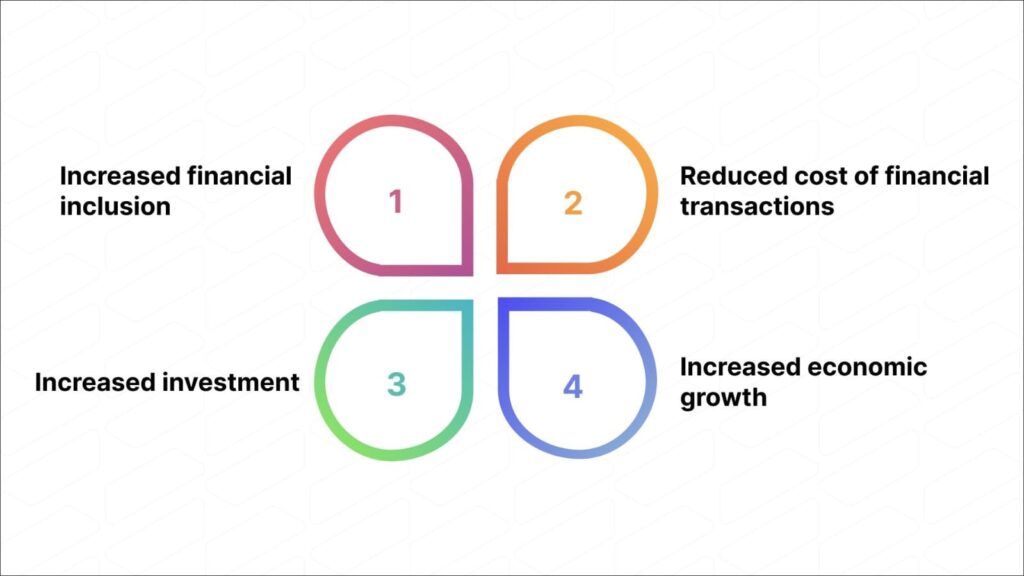

Economic Impact of the E-Rupi on the Indian Economy

Image credit: SUVIT

It will reduce the dependency on the Paper currency. It is likely to make payment faster, and more secure. Its impact will not only widen the economy but society, in general, will be revolutionized and the existing banking system too. Experts realized soon that in the coming times, e-RUPI will be the next Flipkart and Amazon in India. Following the COVID-19 outbreak the introduction of the digital rupee is anticipated to obtain initial satisfaction and commercialization given the trends in UPI and increased confidence in digital payments.

The time is not so far that soon e-Rupi to be on UPI also, one exception is there will be no bank but your wallet availed on the UPI Nexus.

What is the difference between e-RUPI and UPI?

Easy & Secure: The Voucher is authorized via a verification code

- e-Rupi is a voucher-based framework for each beneficiary to get an SMS or QR code on mobile.

- It is people and purpose-oriented and can be used at places that receive this kind of mode of payment.

In what manner e-Rupi Vouchers can be utilized?

The kind of currencies can be used to access financial services from designated retailers and wholesalers selected by the lender banks. In the Quick redemption process (QR) The digital voucher can be redeemed in any center within a few steps.

What is the maximum limit of an e-Rupi?

There are two different limits for the maximum value an e-RUPI voucher can have:

- Issued by a government body: Rs. 1,00,000 (one lakh rupees)

- Issued by a private organization: Rs. 10,000

Source: https://www.bankbazaar.com/

This digital Rupee wallet limit has been defined by RBI across banks and will be updated from time to time as per changing the rates.

Exploring digital currencies for mass adoption is a fascinating topic quite intriguing to touch on, especially in the field of Finance and Technology. Digital currencies such as Bitcoin, Ethereum, and many more in the lists have gained a lot of attention in recent times due to their flexibility and international reach at the global level. Cryptocurrencies on the other hand, such as Bitcoin {are not backed by the RBI } but in the digital plethora it has gained so much popularity due to its volatile nature. The perceptions changed a lot of what we think about money and transactions back then in the past.

However, since The introduction of India’s e-Rupi, they have established such a strong presence that they hit the target of 1 million daily transactions via digital rupee in December: Report. The RBI was reportedly planning the introduction of its wholesale CBDC in the call money market.

In this article, we will discuss and dive deep into some key points to study When considering the imperative of achieving mass adoption of digital currency:

1. Literacy and Awareness

If we look at the biggest blockade to the mass adoption of digital currency products is the lack of understanding and knowledge of the Indian economy.

- How will the process work in an environment where educating is the first step toward a digital banking system? Campaigns and booths related to these currencies in rural are a need of the hour.

- What is the primary step in informing the general public about the essence of digital currencies?

Then after learning about the potential benefits of digital currencies comes into the picture. So first teach then expect the outcome.

2. Regulation and Compliance

Govt and Regulatory bodies play an important role in regulating the unorganized and informal market, which lacks trust and accountability toward people. Cryptocurrencies lack safeguards, leaving the innocent public vulnerable to exploitation. With its sovereign and legal status, the e-Rupi has successfully marked goodwill and gained trust across India. Tight control mechanisms have created a legitimate digital currency ecosystem.

The e-Rupi is more resilient and durable than other technologies against cyber breaches and threats. Backed by Blockchain Technology, a master ledger within the central bank itself makes regulation safer and more protective for vulnerable exposure.

- It makes it easy for the authorities to monitor and track banking activity all around the world.

- All transactions within the authorized network will help in the reduction of corruption, fraud, and other wrongdoings.

3. Increasing User Experience

India has been at the forefront of digital payment innovation for the past decades. Smartphone or internet banking access is a technology game changer. It can speed up the adoption of digital payments at the mass level in rural areas and among socially and economically backward classes. Improving the connectivity and usability will push the digital wallets and platforms to be more user-friendly and can help attract a wider set of audience.

4. Ease of Use and Speed matter

According to Dr. Seth in an interview said ‘’ At the moment cross border is not an efficient system, it takes time at the same time, there is the cost factor”. The point is even cross-border payment takes time then, Here in India transaction speed are key factor for mass adoption. If in the future users or transaction numbers are rapidly outnumbered then digital currency networking needs to be able to handle the load well for a perfect user experience.

5. Partnerships and Collaboration

There is no issue in groups or agreements However, in terms of business purposes, e-Rupi collaboration between industries, governments, financial institutions, research centers, and tech companies can facilitate the increase of digital adoption.

Influence of the e-Rupi on the Fintech Industry

The introduction of the digital rupee will be a turning point for the whole Fintech industry as cash usage declines at the global level. It will shift the payment landscape. With the greater amount of foreign transactions and Indian diaspora widespread over the world, an increase in the accessibility of international level transactions will surely make a giant impact on the fintech industry.

Fintech highlights the e-Rupi expertise in facilitating quicker payments, Such a true mastery for the growing future of Fintech businesses in addition to lessening the dependence on physical cash. Rising Contactless payments give more spots to mobile wallets.

Cross-border transactions beyond the borders

In the headlines of the news is that RBI is in discussion with its counterparts in the US, Hong Kong, and SWIFT for cross-border settlements using CBDC.

- There won’t be any boundary barriers related to the e-rupee Wallet.

- International transactions will proceed seamlessly, requiring minimal time and paperwork, as they fall under the purview of the RBI.

- Cross-border payments CBDCs, could be very effective in bringing down costs further to the rate of 2 to 3 percent.

- CBDC or E-rupee can be used for trade, remittances, or any other overseas digital payments.

92 percent of the world currency is digital.

Source:jzeroblog.com

Limitations and challenges of digital currency as e-Rupi

Cybersecurity has always been an issue in the area of digital networks but it threatens more when Other payment methods are already raising red flags for competitors. Moreover, the e-Rupi is unlike a bank account which earns you interest. The primary issue with e-Rupi is that There’s no way to find it if it gets lost available to recover it from fraud, misuse, and data loss. Sustaining privacy with data protection under any guidelines is not guaranteed in CBDCs. Every transaction entry will leave some traces to detect. To protect the anonymity completely is posing another big challenge for the RBI.

Way Forward

Secured digital ecosystems with strict KYC Norms

- A digital rupee will be a blessing However India’s top regulatory bodies need to preserve risks evolving related to data privacy and strict rules to enforce tight compliance of Know your Customer (KYC).

- It will take a lot of hard work for fiat digital currency to be widely acceptable in India, especially in the interiors like rural areas.

- e-Rupi must meet criteria such as privacy protection, usability, and scalability. Experts say, that in the days to come the user base e-Rupi is expected to widen, with even the private sector using it to deliver benefits to employees and MSME sectors adopting it for business-to-business transactions.

Source: National Payments Corporation of India.

In general, exploring digital currency for mass adoption requires a mixed approach that will deal with technical, and regulatory malfunctions and educational challenges. By addressing these key areas we are going to pave the path ahead for a sustained digital economy.